Meals Reimbursement 2025

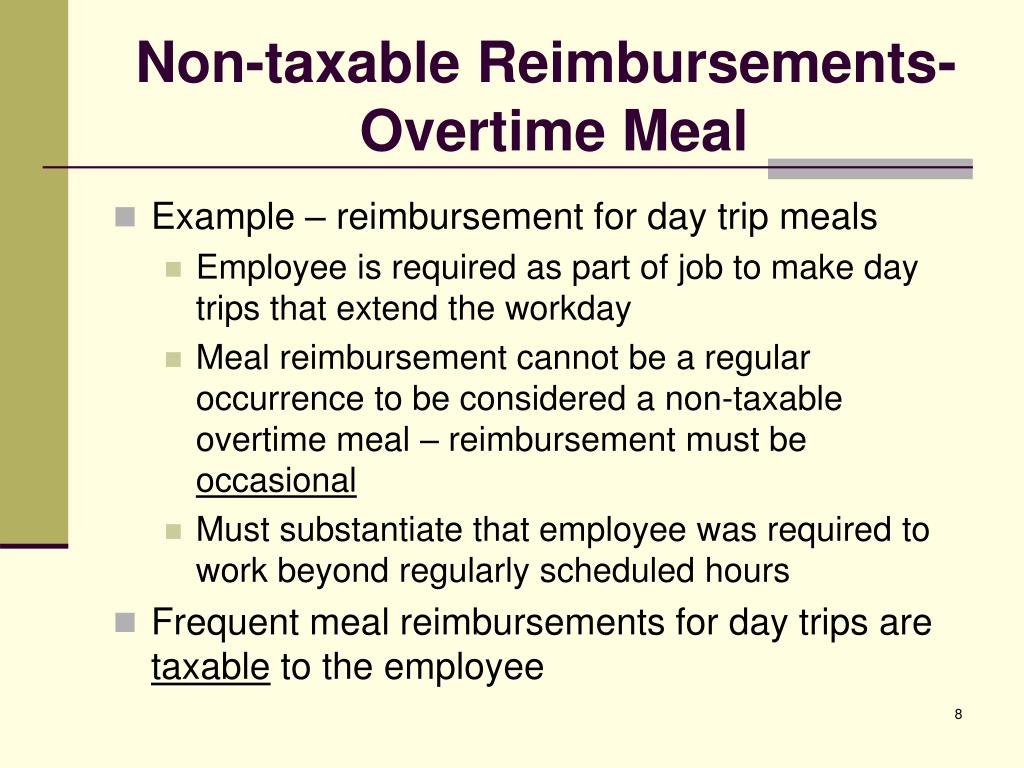

BlogMeals Reimbursement 2025 - Meal Reimbursement Policy Changes Announce University of Nebraska, Allowable meal charges and reimbursements for daily subsistence. Reimbursement for meal and lodging expenses. PPT Meal Reimbursements PowerPoint Presentation, free download ID, In this guide, we’ll cover everything you need to know about writing off meals: Prior to 2025, taxpayers could deduct 50% of their meal expenses incurred.

Meal Reimbursement Policy Changes Announce University of Nebraska, Allowable meal charges and reimbursements for daily subsistence. Reimbursement for meal and lodging expenses.

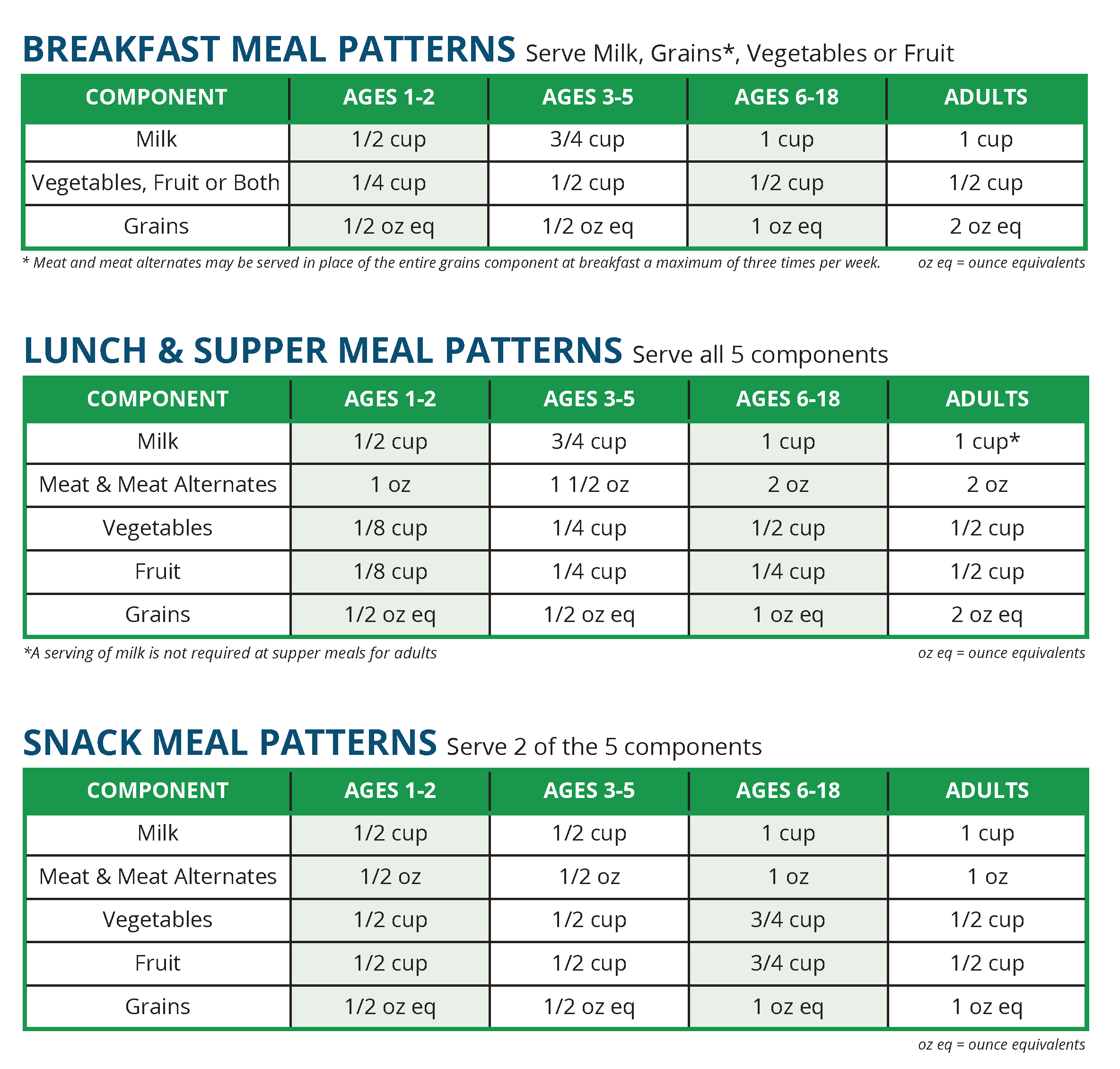

Big Education Ape Meal Reimbursement Rates 202521 Nutrition (CA, Reimbursements for lodging will be capped at $107 per. Allowable meal charges and reimbursements for daily subsistence.

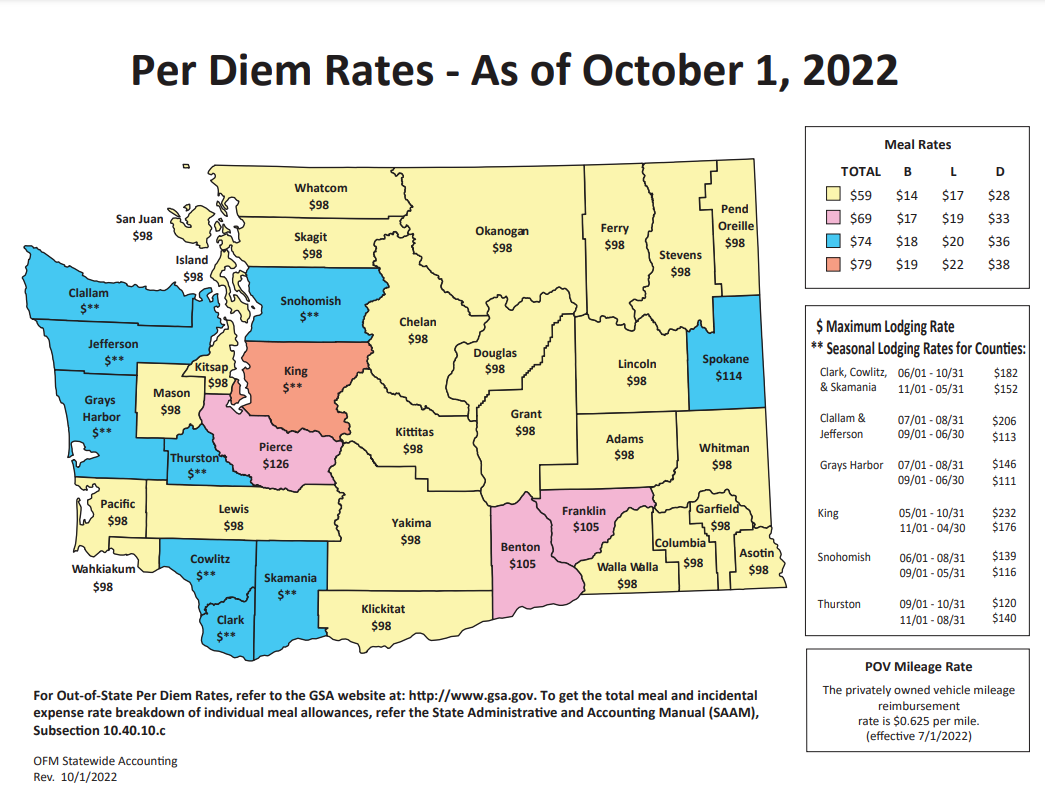

Meals Reimbursement 2025. The maximum state reimbursement rate is $59/day. Find current rates in the continental united states, or conus rates, by searching below with.

Rose Parade Channel 2025. In los angeles the parade will also air. L.a.’s very own […]

Allowable meal charges and reimbursements for daily subsistence.

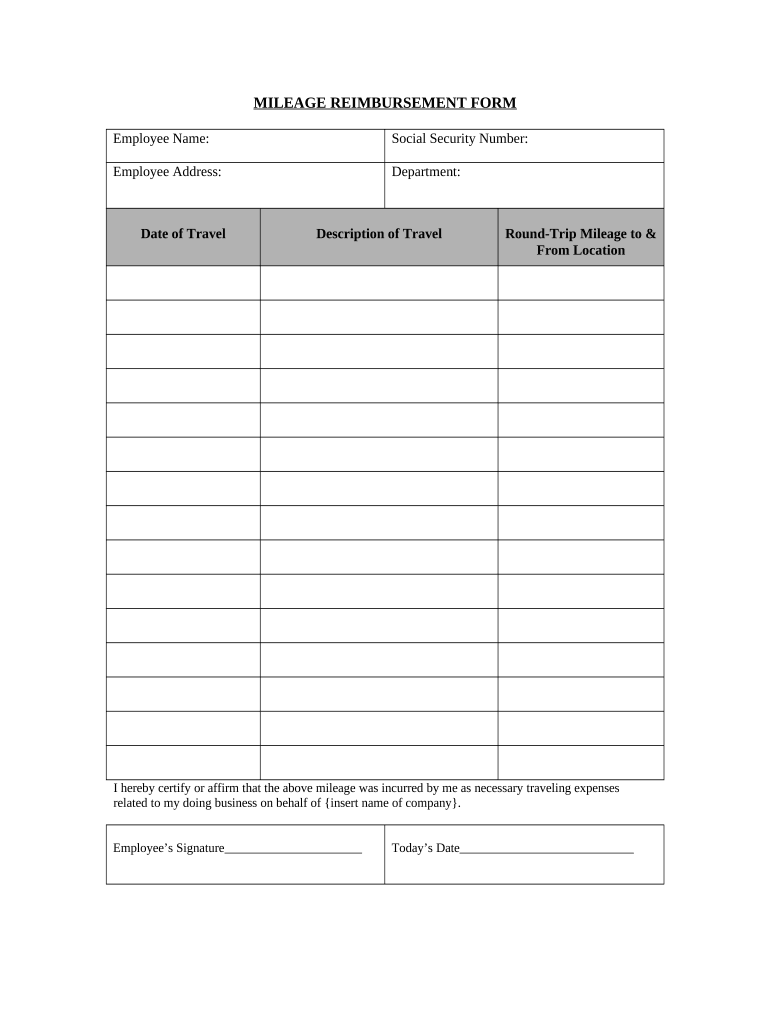

Meal Reimbursement Form Template 123 Form Builder, Meal rates for high cost metropolitan areas. The per diem rate for fy 2025 will be $9 more than last year’s, going from $157 allowed per day to $166.

Irs Per Diem Rates 2025 By State Rona Carolynn, Reimbursement for meal and lodging expenses. Below are the numbers which reflect the national average payments, the amount of money the federal government provides states for lunches,.

Except for the metropolitan areas listed below, the maximum reimbursement for meals including tax and gratuity, shall be: M&ie total = breakfast + lunch + dinner + incidentals.

Chris Brooks Obituary 2025. The albert memorial, on the edge of london's kensington gardens, is […]

Except for the metropolitan areas listed below, the maximum reimbursement for meals including tax and gratuity, shall be:

Reimbursement Form Print Fill Out and Sign Printable PDF Template, If you are reimbursed for the cost of your meals, how you apply the 50% limit depends on whether your employer's reimbursement plan was accountable or nonaccountable. Meal rates for high cost metropolitan areas.